Underwriting Rules for Life Insurance

Life insurance is a maze of complex regulations, risk assessments, and evolving policies, but the Decisions rules engine simplifies every step with seamless, automated workflows.

Tailor rules and underwriting processes to fit your unique needs. Our powerful low-code platform offers drag-and-drop design and customization, minimizing the need for coding.

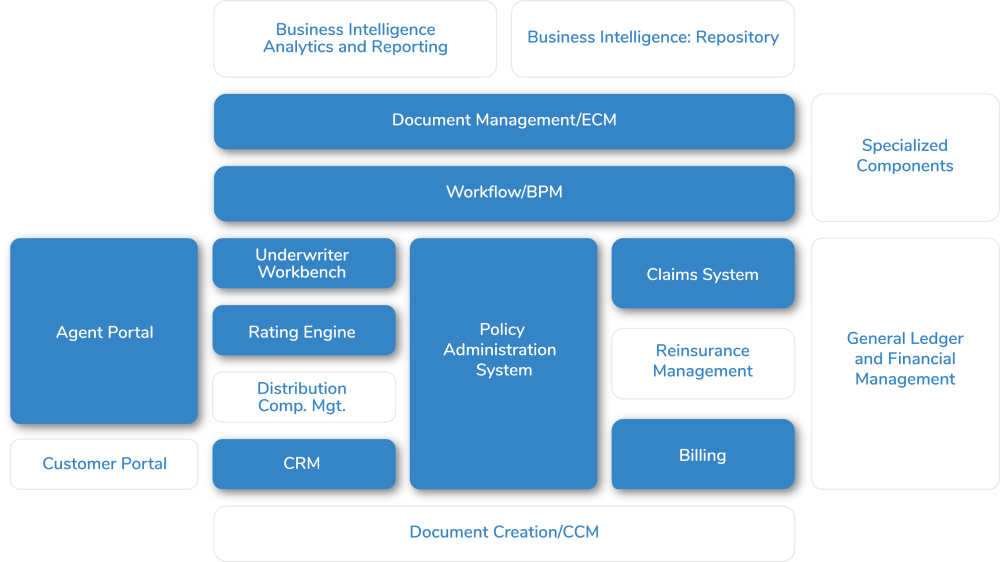

Use Decisions as your automation platform for any underwriting process or as an orchestration layer to simplify integrations and unify data efficiently. Create cross-system rules and processes or unique rules tailored to each system, accelerating data processing, decision-making, and productivity.

Decisions provides comprehensive connectivity of key systems (in blue), with the ability to integrate any additional systems as needed.

Enhance every step of your underwriting with Decisions. From risk assessment to policy renewal, our advanced rules engine accelerates decision-making, ensuring compliance, and elevating customer experiences with less development work and time.

Automate intake, risk evaluation, verification, and premium pricing for quicker decisions and a seamless experience.

Leverage integrated third-party data and rules engines for in-depth risk analysis and compliance measures.

Customize approval workflows and automate document creation, distribution, and secure storage.

Automate compliance checks and regulatory reporting to ensure adherence to industry standards.

Provide proactive support with automated notifications, self-service portals, and chatbot assistance.

Enable policy adjustments and renewals while automating processes for efficient management.

Decisions seamlessly connects with your existing systems and AI tools to automate every step of the underwriting process. By leveraging real-time data validation and intelligent decision-making, it eliminates bottlenecks, accelerates workflows, and boosts customer satisfaction.

Whether responding to market changes or handling increased application volumes, Decisions scales with your agency. Easily modify workflows, rules, and processes on the go, allowing you to stay competitive with faster and more reliable underwriting services. Without coding, managers, too, can easily change business rule logic on the fly.

Decisions’ rules engine enables sophisticated risk management protocols, including Know Your Customer (KYC), helping you identify and mitigate potential risks during the underwriting process. Automate compliance checks and regulatory reporting to ensure your institution adheres to industry standards, reducing the risk of fraud and compliance violations.

“Decisions’ structure has so much power and flexibility. It’s an ideal tool for driving process automation and enhancing overall efficiency.” – The Argus Group

Discover the power of Decisions for faster, more accurate underwriting.