Loan Origination Software for Banks and Credit Unions

End-to-end automation for efficient

and secure lending.

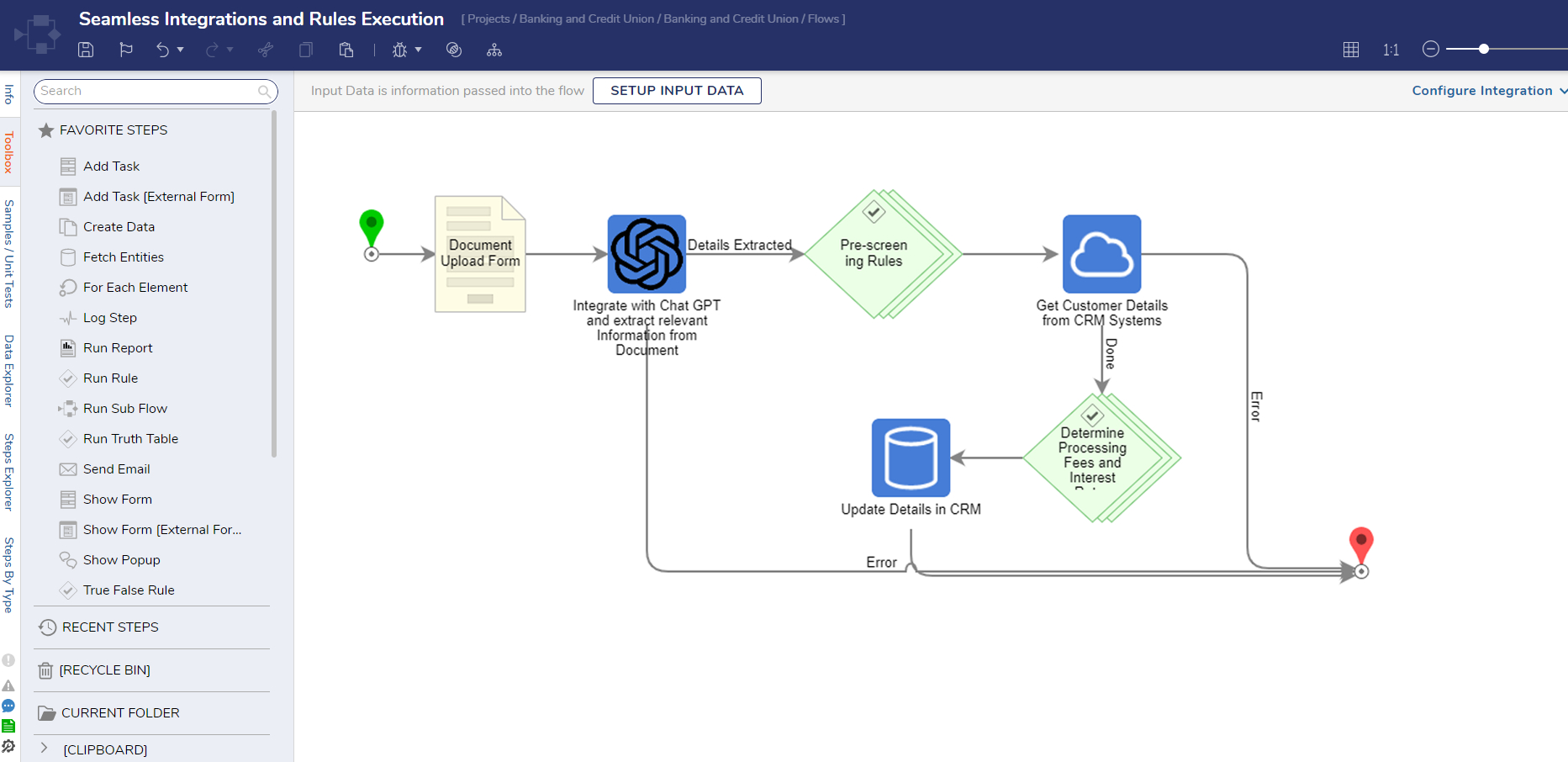

Decisions’ low-code platform enables banks and credit unions to tailor loan origination and consumer credit processes for faster decision-making, risk management, and compliance.

With a powerful rules engine and intuitive drag-and-drop design, Decisions adapts to your specific needs, ensuring accuracy, fraud prevention, and superior customer service.

Application Processing & Onboarding

Automate intake and verification, including Know Your Customer (KYC), for quicker, safer decisions and approvals.

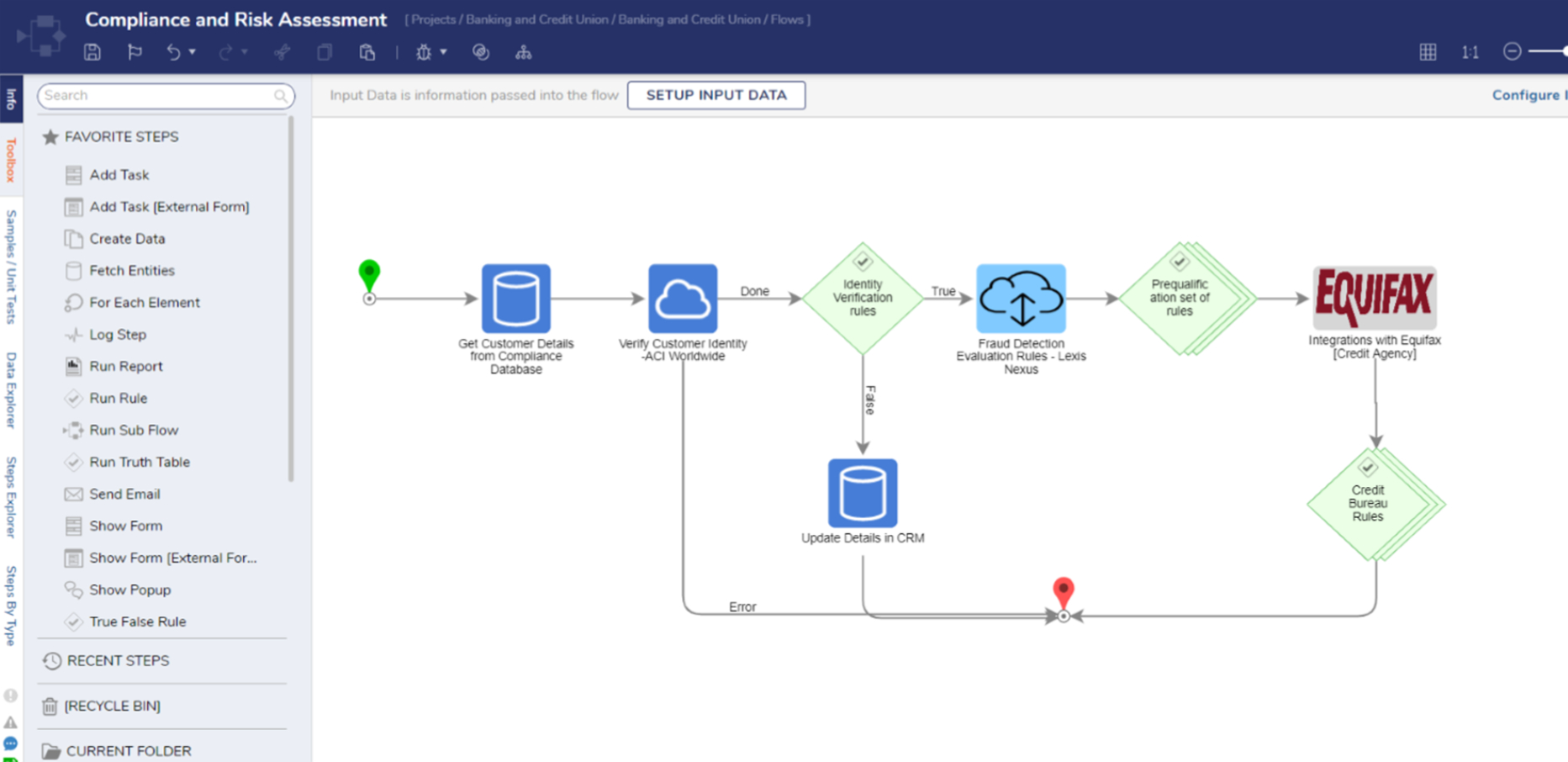

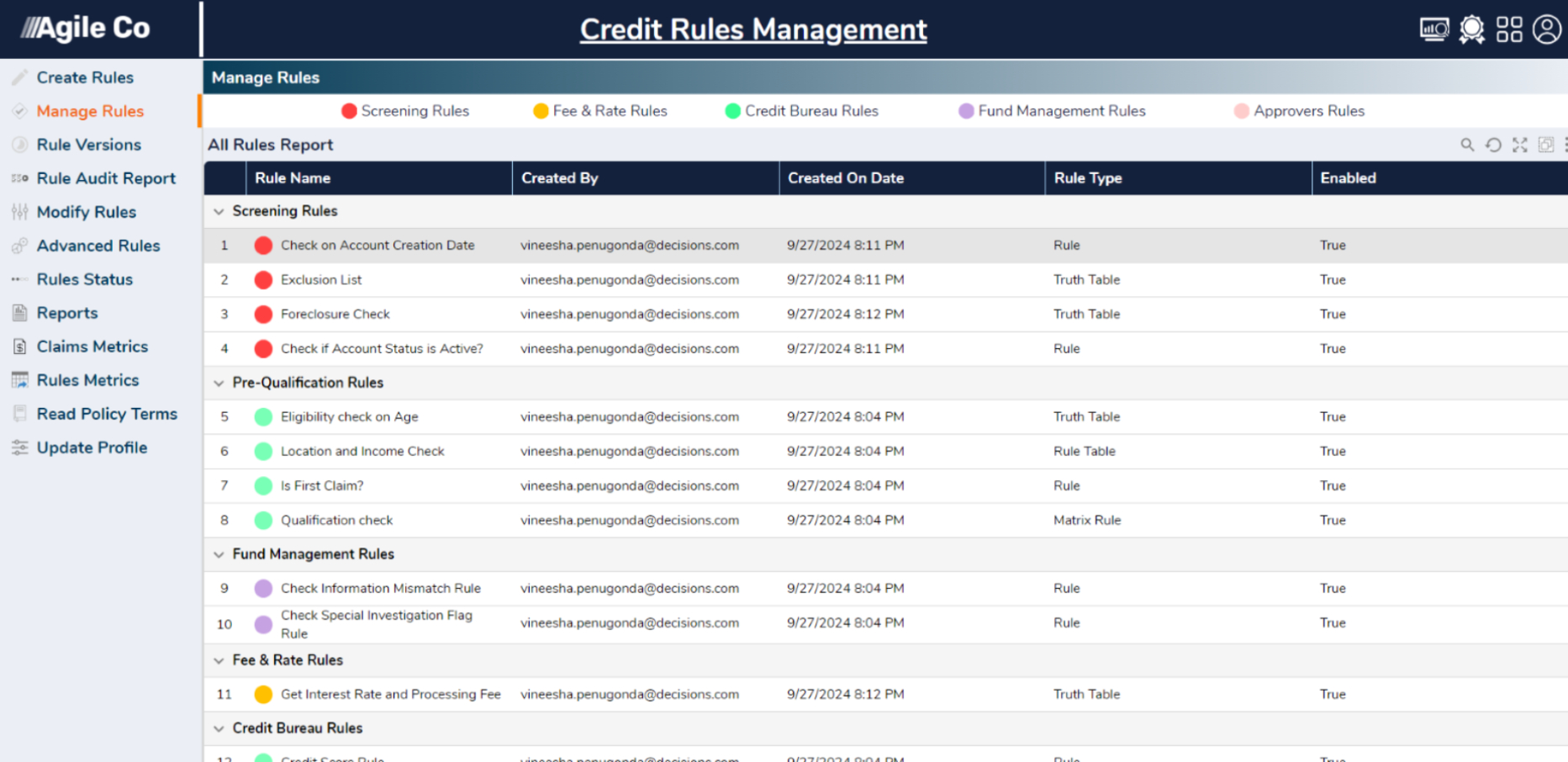

Credit & Risk Management

Leverage rules engines and credit integrations for accurate scoring and compliance with anti-fraud and regulatory measures.

Decisioning & Approval Workflow

Customize approval workflows and automate document creation, distribution, and secure storage.

Funding & Fulfillment

Automate funding disbursement and payment processing for accurate and timely loan fulfillment.

Customer Communication & Support

Provide proactive support with automated notifications, self-service portals, and chatbot assistance.

Loan Modification & Delinquency Management

Enable refinancing and payment adjustments while automating collections and delinquency tracking.