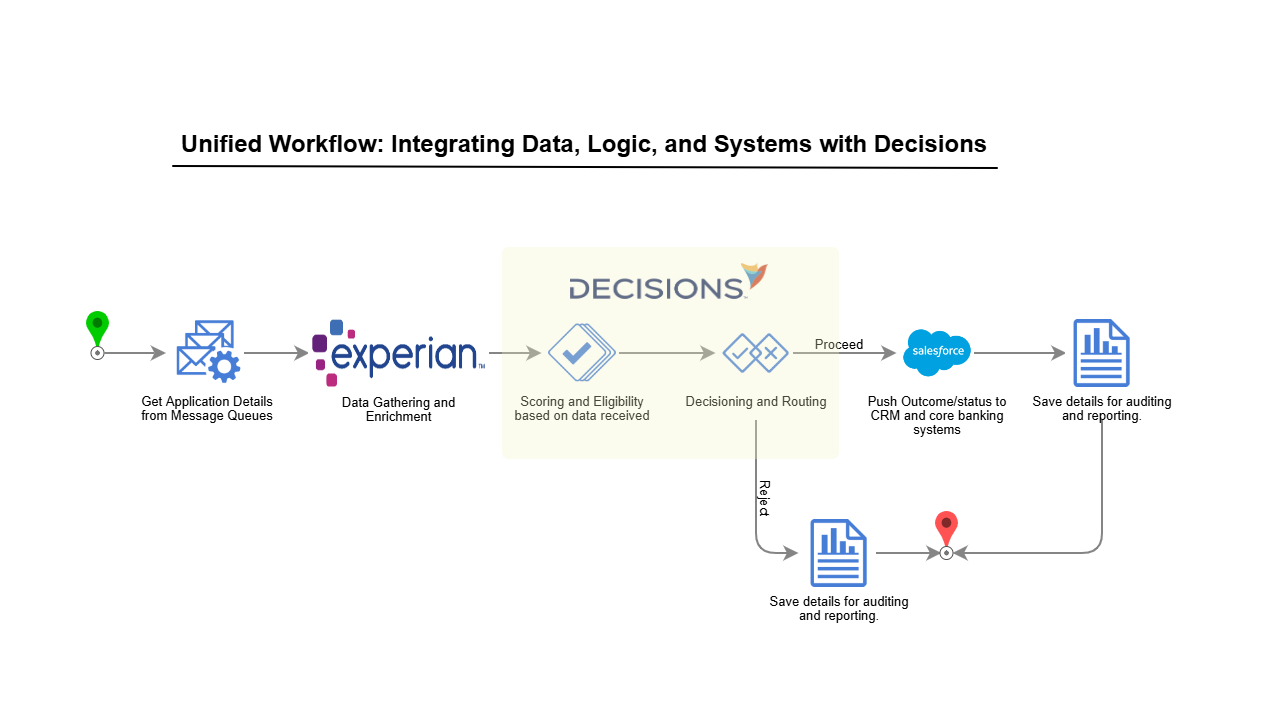

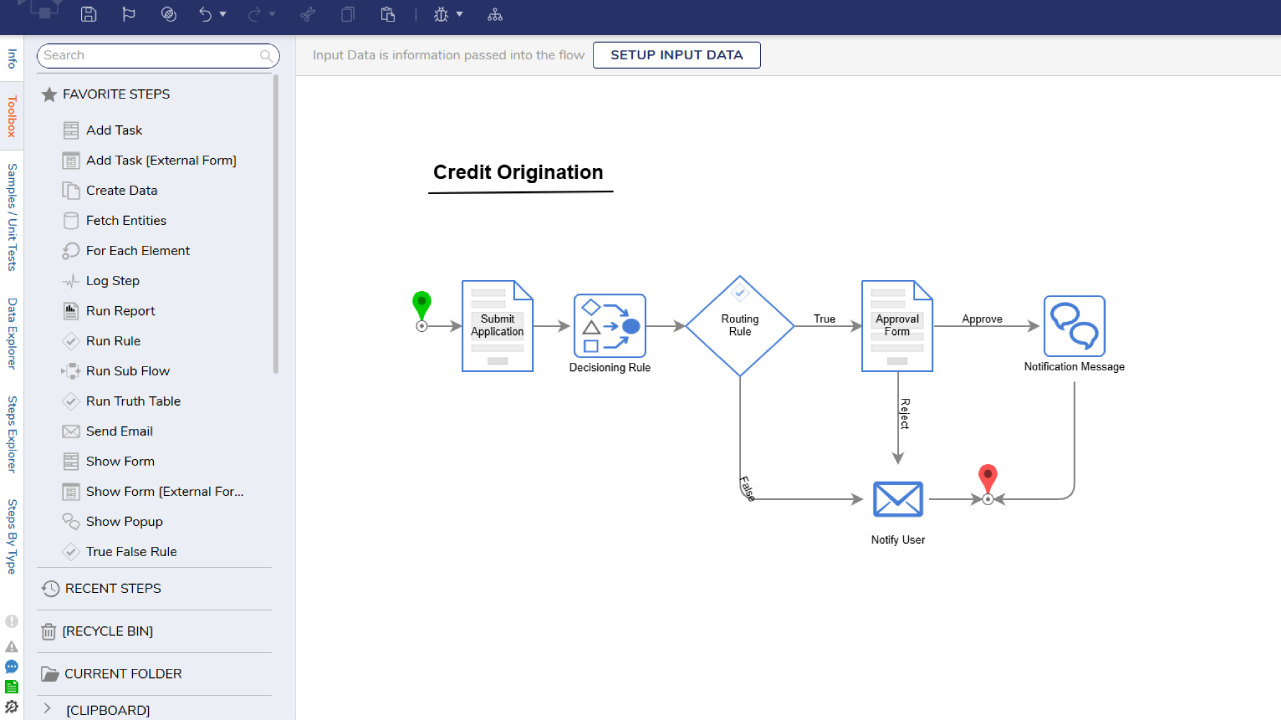

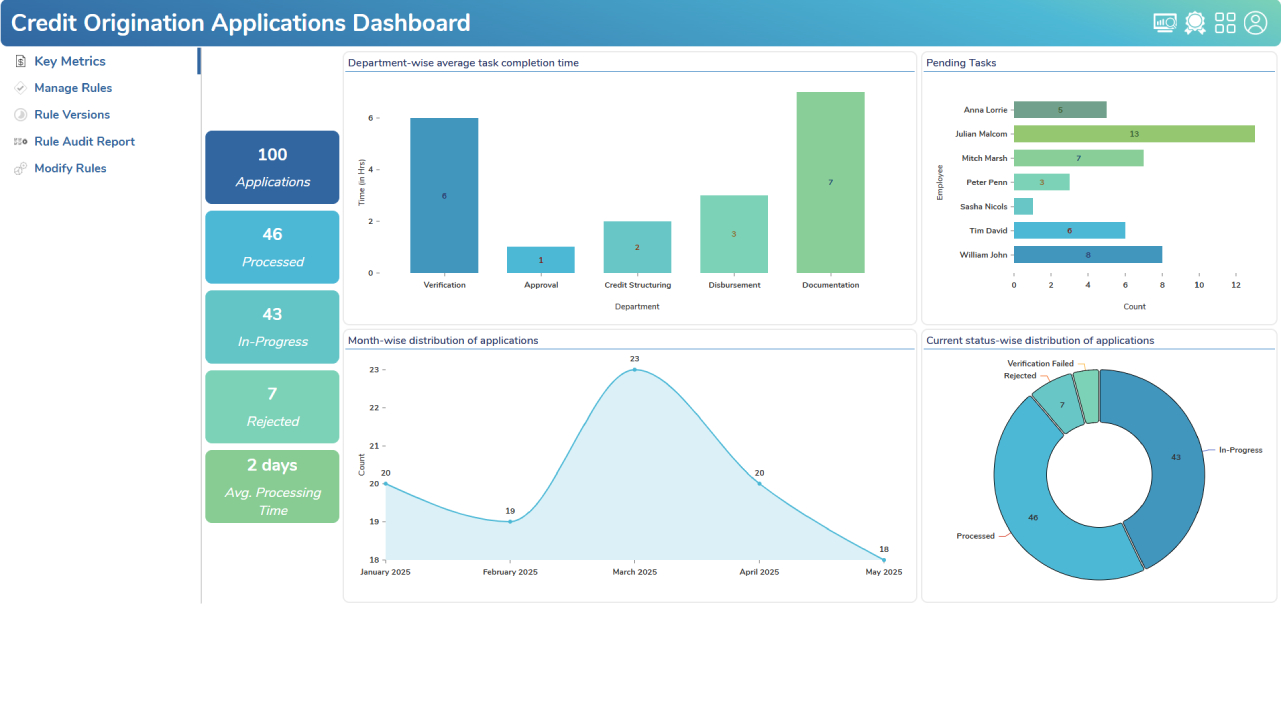

Credit Card Origination

DECISIONS PLATFORM

Design solutions 3X faster, process unlimited rules per hour, and speed the growth of your business with Decisions low-code system.

EXPLORE MORE

More on the Decisions low-code platform.

INDUSTRY SOLUTIONS

USE CASE SOLUTIONS

BUSINESS SOLUTIONS

DECISIONS PARTNERS

Partners drive global growth with Decisions’ innovative low-code business solutions.

Company

We’re building the world’s most capable and accessible Intelligent Process Automation platform.

RESOURCES

Decisions provides webinars, docs, and training to support low-code process automation.