Insurance Underwriting

Flexible, dynamic underwriting.

From policy initiation to issuance and lifecycle management, Decisions improves existing insurance technology by serving as the hub for unified rules, workflows, and integration, making them better, faster, and easily adaptable.

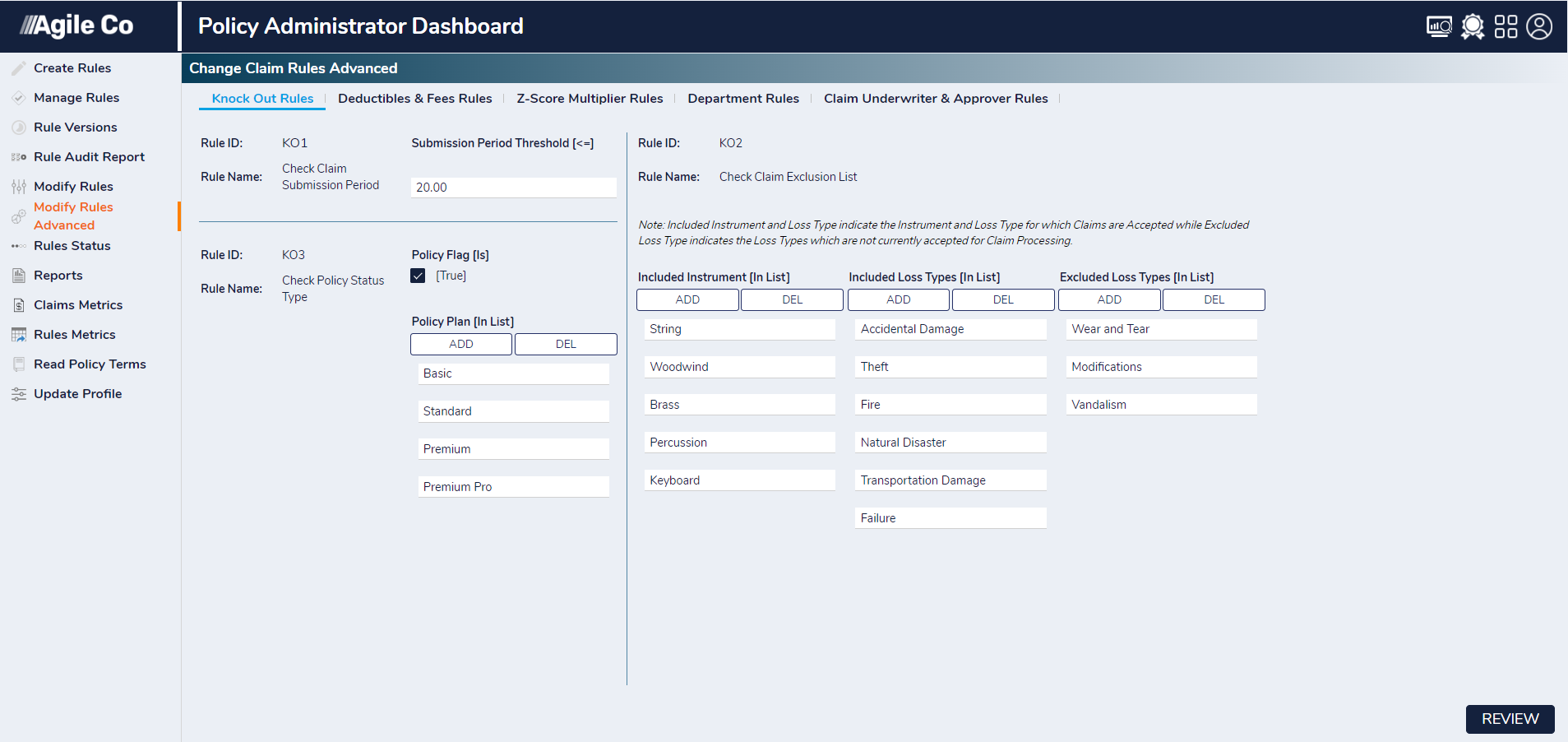

Highly customizable with drag-and-drop design to limit coding, Decisions is also a powerful platform for the creation of a tailored, comprehensive underwriting system. Its flexibility is its strength, giving you the choice to use it in the way that works best for you.

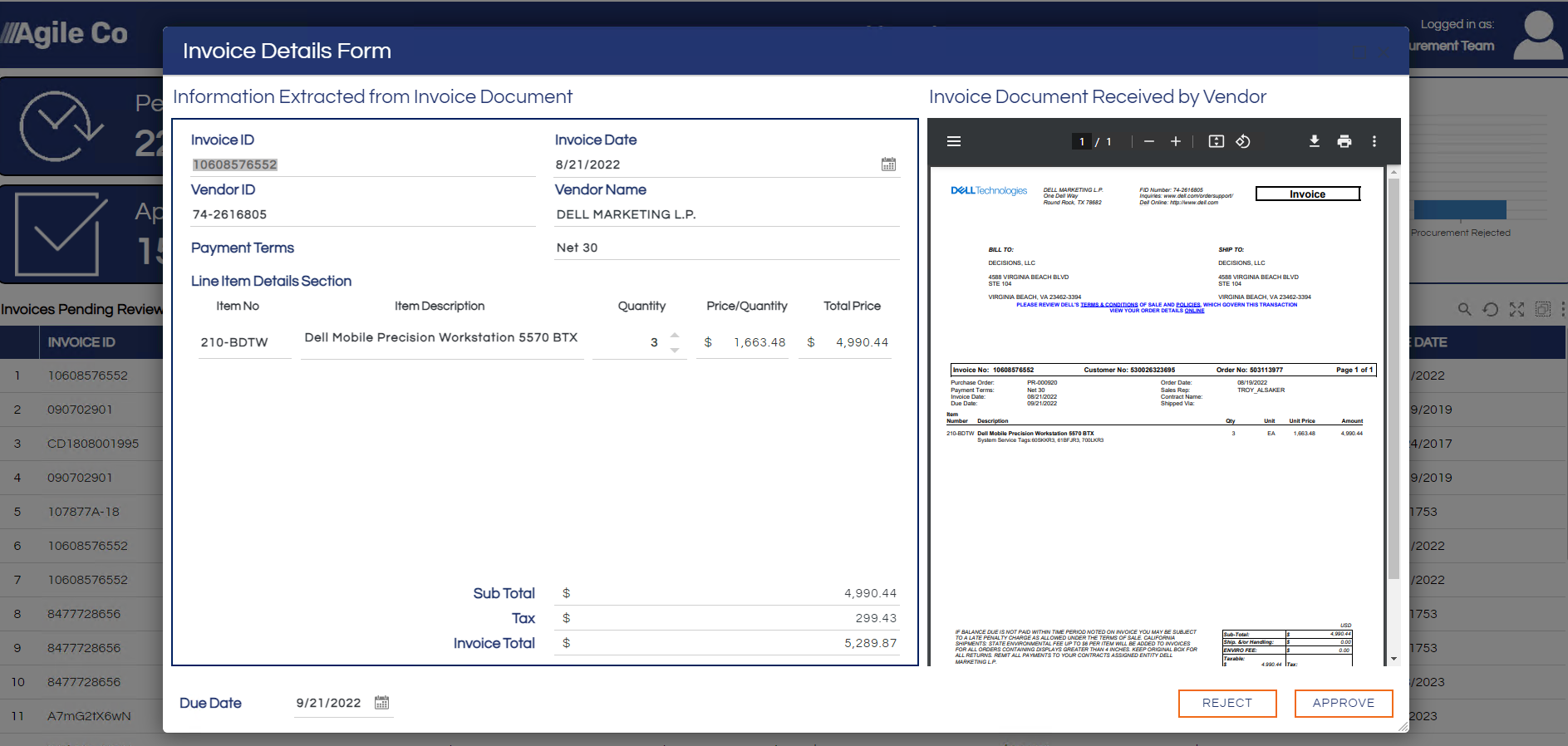

Risk Assessment & Application Processing

Automate intake, risk evaluation, verification, and premium pricing for quicker decisions and a seamless experience.

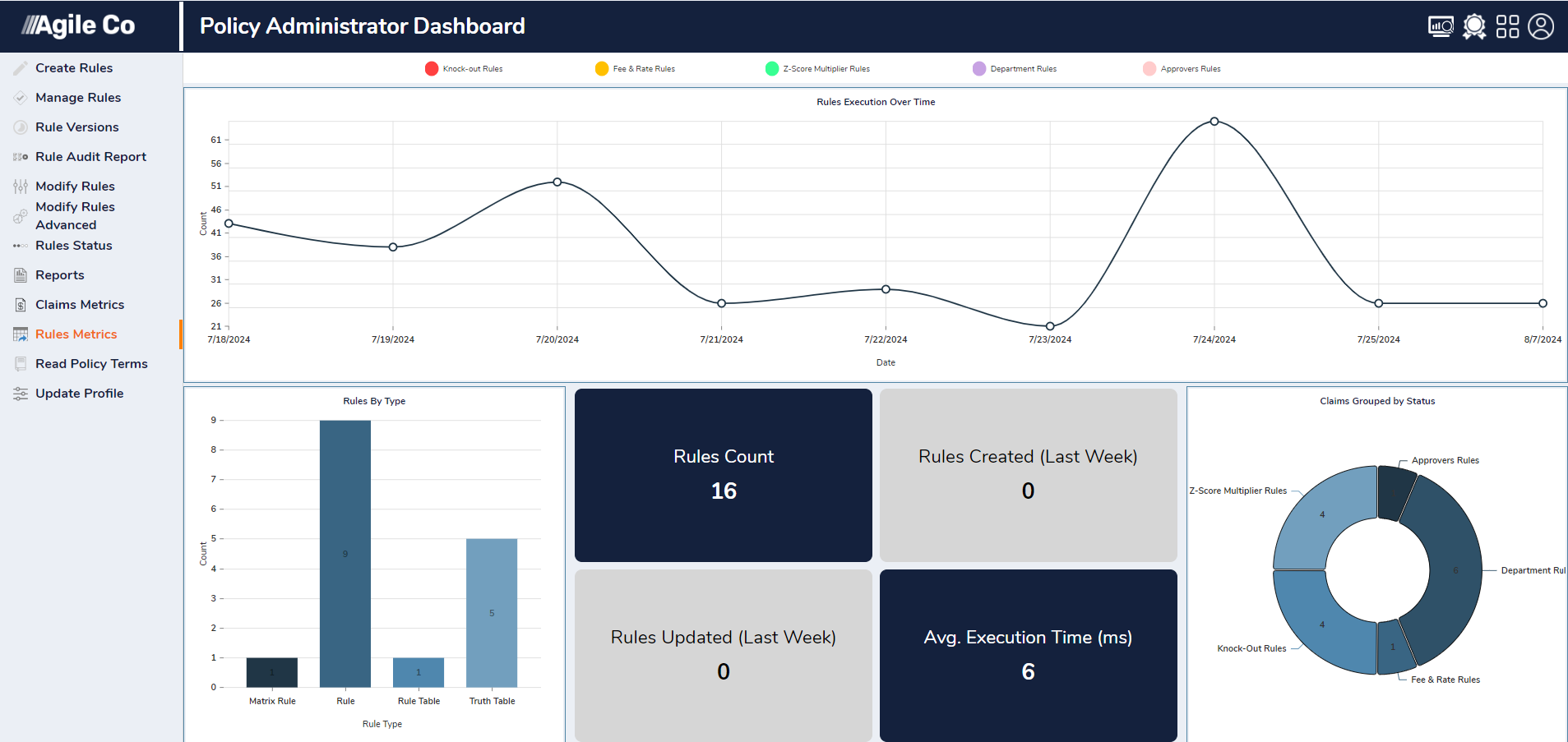

Data Integration & Analysis

Leverage integrated third-party data and rules engines for in-depth risk analysis and compliance measures.

Decisioning & Policy Issuance Workflow

Customize approval workflows and automate document creation, distribution, and secure storage.

Regulatory Compliance & Reporting

Automate compliance checks and regulatory reporting to ensure adherence to industry standards.

Customer Communication & Support

Provide proactive support with automated notifications, self-service portals, and chatbot assistance.

Policy Renewal & Modification Management

Enable policy adjustments and renewals while automating processes for efficient management.